Etsy Sellers: How to Quickly and Correctly Record your Etsy Sales

Hooray!! You finally get the news you've been waiting for - that cha-ching on your phone, and the long-awaited Order Confirmation e-mail in your inbox.

When you've finished dancing around the kitchen, you get on with your order, delight the customer and sit back to a job well done. Then you remember, you still need to record your sale in your bookkeeping. Just one small problem - how do you record your Etsy Sales and what number should you use?

This sounds like a daft question, it's obvious, isn't it? A Sale is a Sale! Well, it should be, but once you start looking you'll find that Etsy gives you a whole collection of numbers, depending on where you look.

There's your Order confirmation, your stats number on your Dashboard, your Order file download, and your Payment Account. They're all laid out differently, all contain different information and some of them don't even seem to add up.

Don't despair. I'll walk you through exactly how you should be recording your Etsy Sales and the best place to find your numbers.

Other Posts you Might Like:

How to Download and Understand your Etsy Payments Account

Do you know how to get started on Pinterest?

How to Record your Etsy Sales?

Your Sales number should include all the amounts that the customer pays to you that you get to keep. So you should be including:

The Price paid - based on your Listing Price

Any Discount that is taken by the customer

Any Shipping / Delivery paid by the customer (less any delivery discout)

You should not be including

Taxes (Sales Tax / VAT) paid by the customer, that you have to pay to the tax authorities

Taxes (Sales Tax / VAT) paid by the customer, that are retained by Etsy to pay over to the tax authorities

Payment Processing fees deducted by Etsy

Where to find the Right Sales Number

Unfortunately, finding the right number on Etsy is not that easy.

Order Confirmation

Etsy Order confirmation for: £9.60

You would think that this would be the obvious place but if you look into the details on your order form you'll soon see that the total shown at the top of your order is the total amount paid by the customer, which is not the amount you should be recording.

You do not include any tax (VAT / Sales Tax) paid by the customer that either you or Etsy then pay over to tax authorities.

Item Total £8.00

VAT £1.60

Order Total £9.60

In the above example you should record £8.00 as the sale. The VAT is owed to the tax authorities and so you would not include this as Income.

Order File

Your monthly download file includes information on all your orders for that month and has a number of different columns showing your figures - unfortunately none of them give you exactly what you need.

Column Q - Order Value

This is the value of your product at the price shown on your listing

Column T - Discount Amount

The amount of any discount taken by the customer, e.g. using a coupon code

Column U - Delivery Discount

Any discount taken by the customer on the delivery charge

Column V - Delivery

The amount of shipping paid for by the customer

Column W - Sales Tax

Any sales tax paid by the customer on sales in your own state

Column X - Order Total

The total of the above columns BUT this also includes any VAT paid by the customer.

As before, the Order Total line includes any VAT/Tax paid by the customer (which you should not include in your Sales bookkeeping). Even stranger, the VAT does not appear in any of the columns on the order file but if you add across the lines on your file you will see that it is added into the Order Total.

Payment Account

If you look at your Sale transactions on your Payments Account you'll see 3 columns; Amount, Fees & Taxes and Net.

Amount

This is the amount of your sale that matches the Order Total on your Order File.

The problem, once again is that any VAT paid by the customer will also be included in this total.

Fees & Taxes

This is the payment processing fee that you pay based on the total amount paid by the customer.

Net

Bizarrely, this is not the net of the above 2 columns but is the amount of the sale less the processing fee. The VAT amount is excluded for this.

In the above example, the correct sale value was £3.00, the customer paid £0.60 VAT to make a total amount paid of £3.60.

The Net Amount of £2.66 is the correct sale value of £3.00 less the payment processing fee of £0.34.

From January 2022

There was a big change to the Payment Account in January 2022. Any tax added by Etsy is now removed and shown separately on a new line so you can get to the right sales value, you just need to add together the original sales line and the “removed” tax amount.

So how do you find the correct sales figure?

Manual Calculation

The only way to get the right figure is to do a manual calculation from either your Order File or your Payment Account, although it is probably easier to do this from your Payment Account.

Download your CSV file each month and open up the file in Excel.

Filter on your Sales transactions, then take your Net Amount and add back the Fees and Taxes. In the above example, you would take £2.66 + £0.34 = £3.00

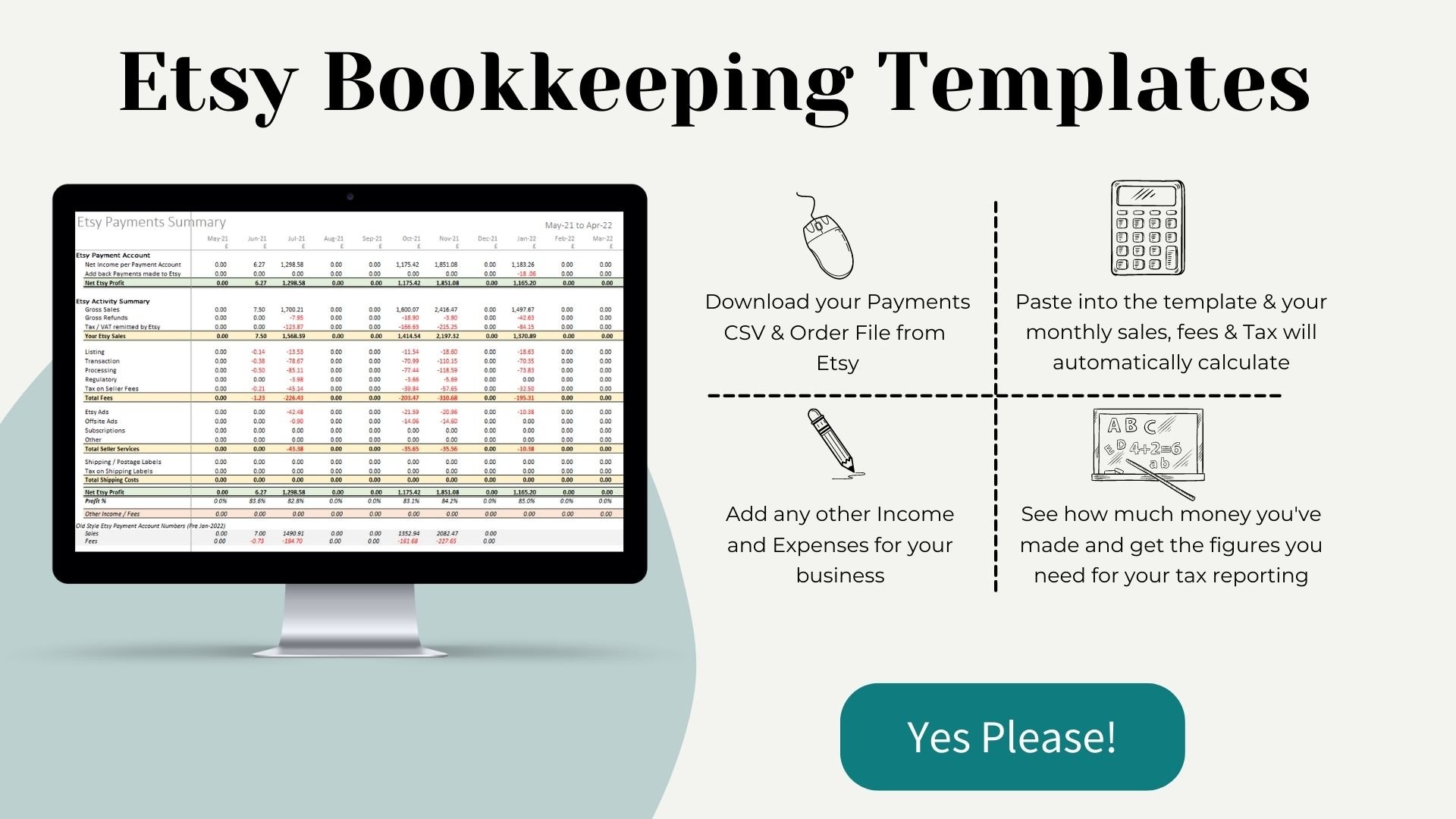

Use a Template

If this sounds way too complicated, then one other solution is to use a preformatted template that has the calculations already built into it. My Automated Bookkeeping Template is one such file that does all this hard work for you.

Just download your Order File and Payment Account each month, copy into the file and job done, your bookkeeping reports will be instantly updated.

Click on the image to find out exactly how to save time on your bookkeeping.

Here's to stress free sales reporting

I hope this post has helped you know exactly how to record your Etsy sales in your books. With a little knowledge, and the right tools in place, you can sit back and watch the sales roll in, safe in the knowledge that you know exactly how to record each one.

No more stress or worry and plenty of time saved to get back to the business you love.

Sarah x

Why not Pin this so you can come back to this article later?