Etsy Payments: How to understand your Monthly Statement

If you are anything like me, getting to grips with your Etsy Payments is one of the hardest parts of running an Etsy shop.

Wouldn't it be great if you could see a simple report for every sale you make? If you could see your income and all the associated fees in one place, you'd know exactly how much you really earned from your sales.

Unfortunately, this isn't possible, at least not yet, and so the only alternative is to get on top of your Payment Account.

This is the 3rd instalment of my series on using your Etsy Payments information to better understand what you're REALLY Earning from your Etsy Shop.

If you haven’t already been there, I highly recommend going back and checking out Parts 1 and 2 of this series:

All about your Etsy Payment Account - where to find it and what it shows

Downloading your Data from Etsy - what you can download, how to do it and how to get your data into Excel (or another Spreadsheet package).

Once you've done that, come back and continue with this post on How to Download your Etsy Payments Statement and Understand what it tells you.

Why should I Download my Etsy Payments Data?

I suppose the 1st place to start is to understand why you should bother downloading your information? Why not just look at it on the screen in Etsy and use the figures you see under the Charts?

I'll give you 3 Good Reasons:

The information you see in Etsy is misleading (Sorry!) - The Sales figure is not accurate as it is distorted with tax and Payment fees

You can't easily check what you have been charged as it is hard to see everything related to 1 sale at once. This means that you won't know if there are any mistakes.

If you want to record your income and expenses into your monthly bookkeeping - you will have to do it manually - & it may not be accurate (see 1 above)

So, hopefully, now I've convinced you that it's a good idea, read on for the HOW & WHAT...

How to download your Etsy Payments Statement

First things first - you need to get your payment account information out of Etsy and onto your own computer.

I recommend that you do this at the start of each month so that you have a complete record of your transactions for the previous month.

PLUS Etsy organises their data this way so it is really simple to do.

Where to Find your Etsy Payments Statement

The option to download your monthly payment transactions is hidden away at the bottom of your Payment Account.

Scroll down below the detailed transactions and click on the month shown (or select "See all Monthly Statements").

HINT: If you want more help in doing this, have a quick look at Understanding your Etsy Payment Account - the instructions are down near the bottom of the post!

Choose the month you want to get the information for, and then click CSV.

You will see a box like the one below (depending on which browser you are using) - hit the arrow next to SAVE and choose SAVE AS - then give your file a name that makes sense to you and save it into a folder on your computer just for these files.

REMEMBER - you will be saving one of these each month so use a logical naming system, so you'll be able to tell them apart later down the line.

For example:

Etsy Payments 201904

Etsy Payments 201905

Open your Etsy Payments Statement File in Excel

Now that we have the information out of Etsy we need to open it up.

For a step by step guide to opening and converting CSV files with Excel please click here. This is a must read if you are based outside North America and use a DD/MM/YY format for your dates

Now you've got your data in a usable format - what does it actually tell you?

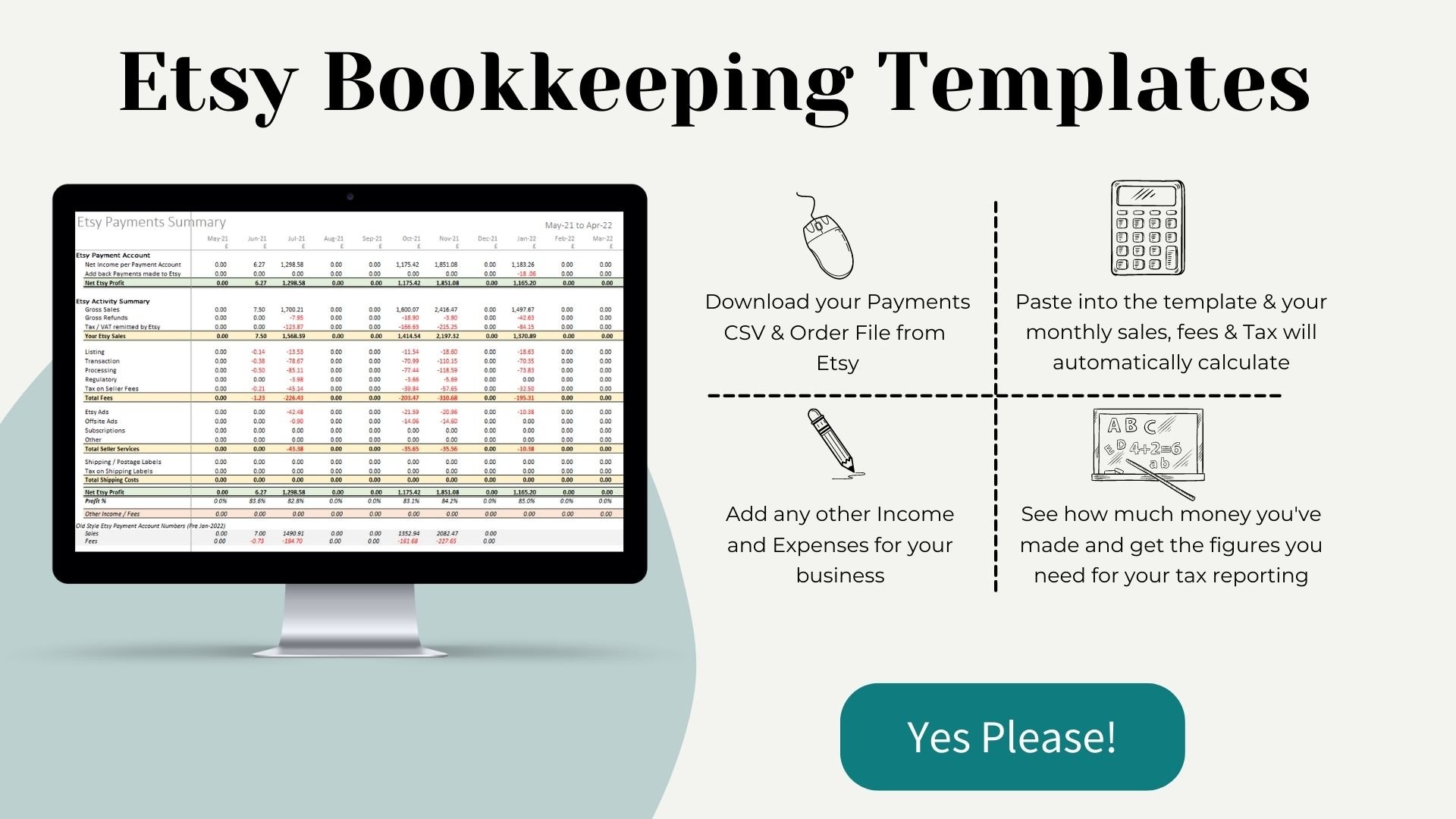

If all this seems like too much hard work, why not check out one of my Etsy bookkeeping templates which do all the hard work for you?

What Information does my Etsy Payments Statement Contain?

The file you now have in front of you should have the following 8 columns:

Date

Type

Title

Info

Currency

Amount

Fees & Taxes

Net

Let’s go through each of these in turn so you know what you’re looking at.

Date

This is the transaction date - the sale date of your item, the date you listed your item etc.

Type

All payment transactions are categorised into one of the following types:

Sale - includes both the revenue from your sale and any payment fees associated with the sale.

Refund - any money paid back to customers from cancelled sales

Transaction - these are the fees paid on the sales transaction - a % of the sale amount (including shipping income and taxes paid by the customer (e.g. VAT, Sales Tax)

Tax/VAT/GST - if you are charged tax on your fees then this is shown separately. The description will match the type of tax that you are charged. This description is also used for the removal of any tax added by Etsy that is retained and settled by them,

Fee - a “catch-all” for miscellaneous charges and also for the Regulatory fee added in some countries.

Listing - any listing fees paid on items from new listings made during the month, plus the relisting fee from any auto-renewals after selling an item, renewing after expiry, manual renewals, etc.

Marketing - the costs of any campaigns for targeted offers or promoted listings. This also includes fees for Off-site Advertising that has resulted in a sale

Subscription - if you pay a monthly subscription fee to Etsy then you see this detailed,

Shipping/Postage Labels - if you purchase your Shipping Labels via Etsy, they will show up here.

Deposit - money paid by Etsy into your bank account

Payment - any money that you have paid to Etsy. This is usually only needed if your monthly fees weren't covered by your Sales income

REQUEST: Please let me know if there’re any more that I’ve missed - drop me a mail and I’ll update the list.

Title

What appears in this column depends on the Type of transaction above.

For all listings and transactions, it will be the listing title of your item.

Weirdly for sales, it will say “ Payment for Order XXX” - who knows why???

Marketing - it will describe the type of campaign

VAT - you get details of whatever fee the VAT was linked to.

Deposits / Payments, it will give the amount paid into your bank account / Paid to Etsy

Info

This is the most frustrating column on the sheet as the information is so inconsistent

(PLEASE TAKE NOTE ETSY!!)

Ideally, this would give a common reference number that you could use to group all your data together for a single transaction.

This would mean you could see your revenue and fees for a single sale and easily work out how much you really earned.

Unfortunately, you can’t do this without adding some serious formula to the sheet.

What you do see is a mix of:

Bill for XXX - for Marketing Costs

Listing References - for Listing Fees and Associated VAT

Order Numbers - for Transaction Fees (plus VAT on transactions and Payments)

The word "Payments" -for Sales - although strangely you see the Order number for any Refunds??

And Blank for Deposits

Currency

This is the Currency of your shop in which you receive payments - NOT the currency that the buyer paid in.

Amount

As with the online version, this is the total Amount paid by the customer (Price + Tax + Shipping - Discount). This is NOT always the Sale Amount that you should record in your books.

BE WARNED - the Sale Amount also includes any VAT / Sales Tax paid by the buyer that has been added by Etsy and settled by them.

You should not include this in your Sales / Income Reporting.

Fees & Taxes

All fees and associated taxes plus any Payments that you have made to Etsy.

This will include Payments Fees due on any Sales made during the month.

Net

In theory, this should be Amount less Fees and Taxes but as you'll have read in my earlier post, Etsy has a strange way with these numbers.

(Seriously - you need to Go and read it now if you missed it!! - you need to know the problem with this calculation),

Positives are amounts due to you from sales

Negatives are amounts you owe to Etsy from Fees and Taxes

NOTE: Deposits made do not show up in any of these columns - Amount, Fees & Taxes or NET. Strangely, Payments that you have made for fees due ARE included (in the fees column) so the end result of the report is not really accurate.

What else is Included / Not Included in your Etsy Payments Statement?

Running Balance

When you look on your account via Etsy there is a final column that shows your running balance.

When a payment is made to your bank account / or you make a payment to Etsy, this is reflected in the balance column so that it shows the true current balance of what you are due / what you owe.

Once you download your information, this final column is missing. You need to do some manual calculations to work out your running balance.

Balance Transfer

If you download your information for 2018, another item in your payment account that might throw out your numbers is the "Balance Transfer".

When Etsy launched the new look account at the start of October 2018, they needed a way to get your "Current Balance" correct and so they added a line with the starting balance called "Balance Transfer"

This is fine when you are looking at your report online but if you download all of your transactions for 2018 then this effectively "double counts your transactions and so can distort your final balance.

Again - you'll need to ignore this from your downloaded report.

How to use your Payment Account Information

OK, so now you have got your Etsy Payments data into Excel and you know what information is shown. The final question is what do you do with it now??

In my next post, I’ll show you a couple of quick ways to make your data a little more user-friendly. I'll also show you what data to input into your Monthly Income and Expense Report to accurately report your Earnings from Etsy.

Sarah x

Why not Pin this so you can come back to this article later