Etsy Bookkeeping - do you know how to get started?

You've set up your shop, added your listings and hooray!!!! you've started to make sales. Now comes the really fun part :-) - tackling your Etsy Bookkeeping. The problem, and don't worry - you are definitely not alone in this - is knowing how to get started.

Well - fear no more. I've got you completely covered on this and I'm here to help you through every step of the way.

Etsy Bookkeeping - the Overview

Before you start recording your transactions you need to get prepared. Get organised, prepare your information and calculate the numbers you need. Only then should you start recording your transactions. That way - you'll have everything you need at your fingertips and can power through your checklist in no time.

To get you started and make it easier to see exactly what you need to do each month, don't forget to download your FREE bookkeeping checklist. You can tick off your tasks every month, see exactly what you've done & what you still need to do throughout the year.

Get Organised

Choose your Bookkeeping Template / Planner / Software

As soon as you set up your shop on Etsy you should set up your bookkeeping system. Whatever you choose, get it in place and you can start recording your expenses even before you make your first sale.

Your system may be as simple as paper and pen if you are just starting out. The most common option though, is to use a spreadsheet, as this does your maths for you. You can either create a spreadsheet yourself or you can purchase a spreadsheet template already set-up specifically for this purpose. The final option is to use dedicated accounting software.

What do you need for tax reporting?

Once you've chosen your system, it is also worth taking the time to find out what your responsibilities are for tax reporting. These vary between countries and even states/regions so make sure you know what is required, when it is needed and what paperwork you need to keep.

I'd also recommend finding a local expert, bookkeeper or accountant to help you. They'll make sure you are fully covered and have everything in place that you'll need.

Getting things right from the start will make everything so much easier as you start to grow.

Prepare your Information

You will save a lot of time in the long run, if you prepare everything before you start recording your transactions. This means that you're not having to go backwards and forwards all the time and will not be searching around for the right report when you're entering your next number.

Just a reminder that this post is focused on your Etsy bookkeeping, so I'll mainly concentrate on the Etsy information that you need to get in place. In part 2 of this series I'll come back and cover all the other information that you'll need for the rest of your business.

Download your Etsy Data

Before you start recording your figures you need to download all the reports that you need. This will speed up your admin as everything will be at your fingertips. It is also good practise as you'll have the back-up to your numbers which will be needed if you ever get audited or have to provide support for your figures.

Which Etsy Reports to Download

Etsy Payments Account CSV

The main report to use for your bookkeeping is your Etsy Payment Account. This gives you the figures what you need for recording your Sales and Fees.

Etsy Orders File

This is useful as it gives you a breakdown of the total order amount and is vital if you want to separate out Shipping charged to customers. It also contains some useful information on Sales tax.

Etsy Order Items

This is a further breakdown of your order report and gives the the details of individual products within each order. This is essential for VAT reporting but can also be helpful if you want to see more detail on your shops performance at a product level.

Etsy Deposits

This is a report showing every deposit made by Etsy into your bank account. It is easier to use this report for deposit information than your Payment Account as it is not very well laid out there. This is useful for reconciling your bank account and checking you've received everything you were expecting.

Calculate your Etsy Sales Numbers

Your sales income should include Product Sales, Shipping charged to customers and any refunds paid back to customers.

Unfortunately, none of the downloaded reports give you the exact sales numbers that you need for your bookkeeping. Because of this you need to do a few calculations to get to the right figures.

I have written a detailed post on getting the right sales number for your shop so won’t repeat all this again. In brief:

Download your Etsy Payment Account CSV and open it up in a spreadsheet.

To find your Sales numbers in your payment account, filter by type and select Sales and Refunds.

Remove any tax/vat retained by Etsy

If tax has been charged to a customer and that tax is held by Etsy to be paid to the authorities on your behalf then this tax should be excluded from your sales number.

You’ll see 3 columns of numbers on your payment account; Amount, Fees & Taxes and Net.

Amount

This is the amount of your sale that matches the Order Total on your Order File. The problem, once again is that any VAT/Tax paid by the customer will also be included in this total.

Fees & Taxes

This is the payment processing fee that you pay based on the total amount paid by the customer.

Net

Bizarrely, this is not always the net of the above 2 columns but is the amount of the sale less the processing fee. Any tax that is collected by Etsy and retained by them to be paid over to the tax authorities is excluded for this.

In the above example, the correct sale value that you should report is £3.00, the customer paid £0.60 VAT to Etsy to make a total amount paid of £3.60. The Net amount of £2.66 is the correct sale value of £3.00 less the payment processing fee of £0.34.

The simplest way to get the correct sales number for all lines is to add a new column and add together your net column and your fees & taxes to get to a “true” sales number.

The same applies to refunds.

HINT: From January 2022, any tax added by Etsy is removed in a separate line on your Payment Account.

Identify your Shipping Income

Any shipping that has been paid by customers (or refunded) is included in the above sales numbers. If you want to split shipping out separately in your bookkeeping (optional) then again, you need to find this number on your Order file in Column Y

Remove any tax/vat that you have to pay to the tax authorities

If tax has been charged to customers and Etsy pays that tax to you for you to pay to the authorities then that tax is included in the Net column on your Payment account.

To exclude this from your reported Sales income you need to find the amount of that tax and deduct it from the total sales number calculated above.

Sales Tax

You will find this on your Order Report.

Add up the total in Column Z and deduct this from the sales number you calculated above.

VAT

If you are a VAT registered business, then unfortunately there is no easy way to find out the amount of VAT charged each month. You will need to use your OrderItem report and perform a manual calculation of the VAT included in your Order total. This also needs adjusting out of the Net figure in your Payment Account.

You can read more about Etsy and VAT in this detailed post here.

Record your Transactions

At the simplest level of bookkeeping, you could just record 2 numbers each month, Sales and Fees and that would be sufficient (please don’t just record the amount of money actually paid to you by Etsy as this understates your true income and gives you a distorted view of your business).

It is better practise however to break down your numbers a little further as this will give you a better understanding on your business performance.

Income

Record your product sales, refunds and shipping. I like to record these as 3 separate lines to give me better information about my business but you can just record 1 figure if you prefer.

Any tax liabilities for tax collected from customers that you have to pay over to the tax authorities should also be separately recorded so that you have the figures available when you have to do your tax calculations

Fees

You can record your Etsy fees as a single number, however I recommend breaking them down for better understanding. At the very least I would suggest splitting your fees between those directly related to your sales (payment processing fees, transactions fees, listings etc) and those related to marketing activities.

You find the fees on your Payment Account download in the Fees & Taxes column and can filter by type to see each individual fee type.

If you are charged VAT/tax on your fees then this should be included as an expense as it is a cost to your business. If you are a VAT registered business however, record this within your tax numbers as you should be able to reclaim these from the tax authorities.

Shipping / Delivery Costs

If you buy shipping labels through Etsy then these can also be found on your payment account. If you buy them separately then be sure to include them in your expense reporting.

Financial Housekeeping

Recording your transactions is not the end of your bookkeeping tasks. To make sure that everything is correct, accurate and can be backed up I suggest you get into the practise of taking time for a little Financial Housekeeping each month as well.

Reconcile your Payment Account

Check that all your numbers have been correctly reported - you should be able to match your Deposits report (what you have received in your bank account) with the net amounts that have gone though your Payment Account.

If you’re not sure how to do this effectively then watch out for a new post to explain in more detail.

You can also check out the Etsy Deposits Manager which has this reconciliation built in as one of the automated reports.

Conclusion

Etsy bookkeeping can be really complicated as there are so many different reports that show different figures and rarely match or are comprehensive in what they include.

Whenever you feel overwhelmed, remember that all you are trying to do is to record your Sales Income and your fees paid.

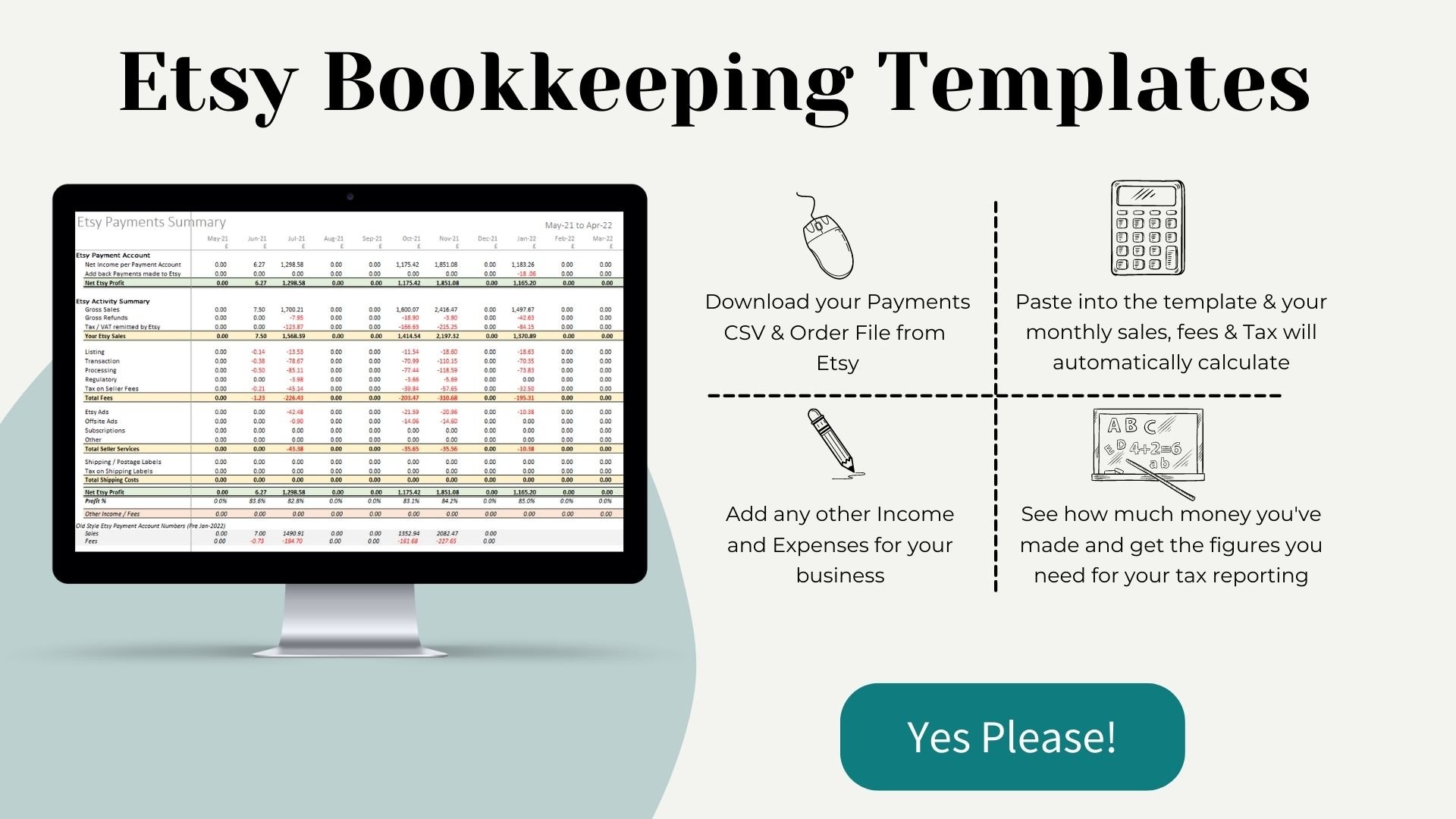

If your head’s spinning and you're feeling even more confused that when you started, then why not try out one of my Automated Bookkeeping templates?

Just copy and paste your Payment Account and Order file and all your calculations are done automatically for you. You will get a monthly income and expense report showing all your key figures in an easy to use format.

Next Steps

Your Etsy numbers are only 1 part of the bookkeeping that you need to do for your business. Read on for Part 2 when I cover all the other numbers and tasks that you should be recording.

Before you go, don’t forget to download your Monthly Bookkeeping Checklist so you can tick off every step each month and get your bookkeeping sorted.

Happy Bookkeeping!!

Sarah x

Why not Pin this, so you can come back later?